Catherine Lee’s allegation that adding a corporate income tax to real estate investment trusts (REITs) would generate $64 million in revenue is baseless and unsubstantiated by any credible source (“REITS should pay taxes like rest of us,” Star-Advertiser, Island Voices, Jan. 27).

The state Department of Taxation (DoTax) determined in 2019 that applying a corporate income tax to REITs might produce $2.2 million in revenue the first year and possibly $10 million annually thereafter.

DoTax cautioned this change in tax status would compel REITs to utilize tax deductions and credits — like most corporations — and not pay any corporate income tax. Moreover, the current economic shutdown has caused a downturn in tax revenues for all businesses, including REITs.

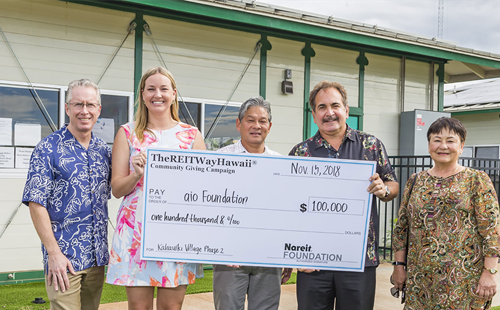

REITs annually pay hundreds of millions in state and county taxes and support thousands of jobs. It’s disappointing false allegations continue to be made despite the availability of facts. Making bogus, unsupported claims to demean REITs’ importance is wrong and bad for Hawaii.

Gladys Quinto Marrone

Executive director, Nareit Hawaii