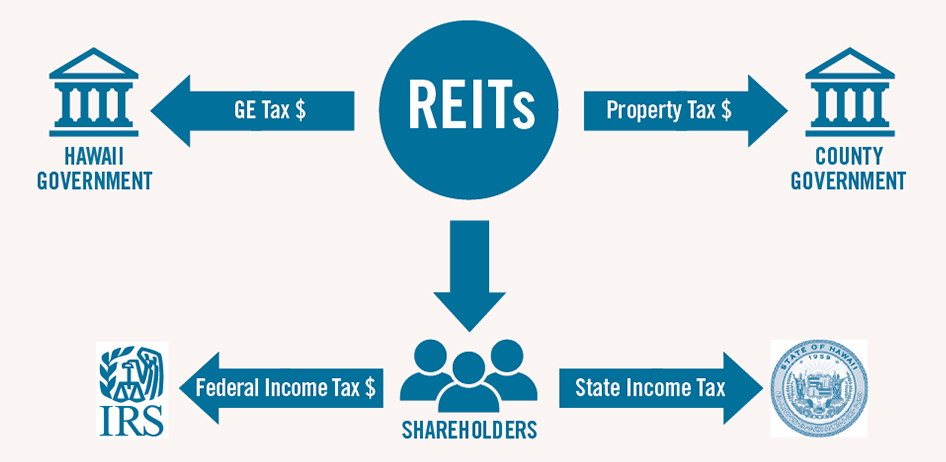

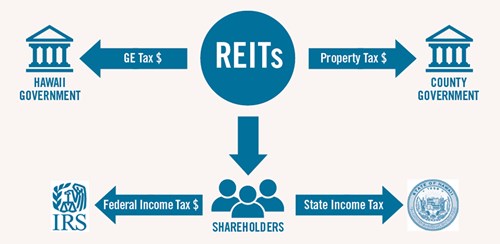

How are REITs taxed?

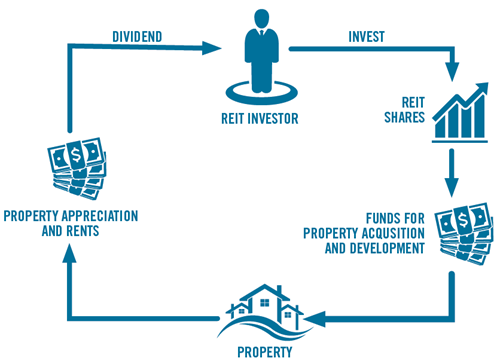

Unlike partnerships or other businesses, federal law requires REITs to distribute at least 90% of their taxable income to shareholders as dividends. Most REITs distribute 100%. This income is taxed at the stakeholder level by the IRS. These shareholders also pay income taxes on these dividends at the state level if they live in a state, like Hawaii with an income tax.

Why No Corporate Income Tax?

In exchange for the requirement that REITs distribute nearly all of their taxable income, federal law allows REITs to deduct the dividends paid to shareholders. Those dividends are therefore not taxed at the corporate level before distribution. If REITs retain any taxable income, they pay corporate tax just like other corporations. Nearly all states with a corporate income tax, including Hawaii, currently follow the same tax model as the federal government, which means REITs don’t pay state corporate taxes on amounts distributed to their shareholders.